voluntary life and ad&d worth it

No Visits to the Doctor. How is voluntary life premium calculated.

Accidental Death And Dismemberment Insurance What You Need To Know

Is Voluntary life ADD worth it.

. There are several options for purchasing both ADD coverage and life insurance. Supplemental ADD coverage could be a wise investment regardless but understand that ADD doesnt cover you for any type of death or dismemberment. Voluntary life insurance is an employee benefit option offered by many employers to their employees.

Ad 2022s Top Life Insurance Providers. ADD insurance is not a. Accidental death dismemberment ADD insurance is a type of insurance commonly added as a rider to a persons health insurance or life insurance.

The premiums are tied to the amount of basic voluntary life insurance you purchase. It was an optional addition to the term insurance Accidental Death and Dismemberment. Voluntary Term Life Insurance.

Voluntary accidental death and dismemberment ADD is a limited life insurance coverage that pays the policyholders beneficiary if the policyholder is. Accidental death and dismemberment insurance ADD for example is a benefit many companies offer but few. People with riskier jobs pay higher premiums than people with low-risk employment.

Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. Essentially would pay if you died in an accident but not of natural causes. With term life insurance the employee is covered for a specific term 1.

Voluntary term life insurance is the most common type of voluntary life insurance offered to employees. Get an Instant Free Quote Online. Just Click the Best Policy Buy Life Insurance Easily.

The employee pays the monthly premium to the insurance company. If your company plans to pay for coverage you will find the low premiums for ADD insurance a pleasant surprise. An ADD policy may be a good idea especially if you work in a high-risk job.

A financial protection plan that provides a beneficiary with cash in the event that the policyholder is. The cost of ADD insurance is lower than that for traditional life insurance because the coverage is limited to accidents only. Typically the group life is for included as a fringe benefit at no cost to the employee and is tax deductible by the employer.

Rates will vary from insurer to insurer and can start as low as 450 per month for 100000 of coverage. Over 10 years you would pay 1250 for a 100000 voluntary life insurance policy or an average of 125 per year. Accidental death and other covered losses occur rarely.

Ad Our Comparison Chart Did the Work. Voluntary Accidental Death And Dismemberment Insurance - VADD. Voluntary life insurance is a.

I believe as long as its below 50k it is not. ADD insurance covers accidental death and injuries but offers much less protection than life. Life insurance vs.

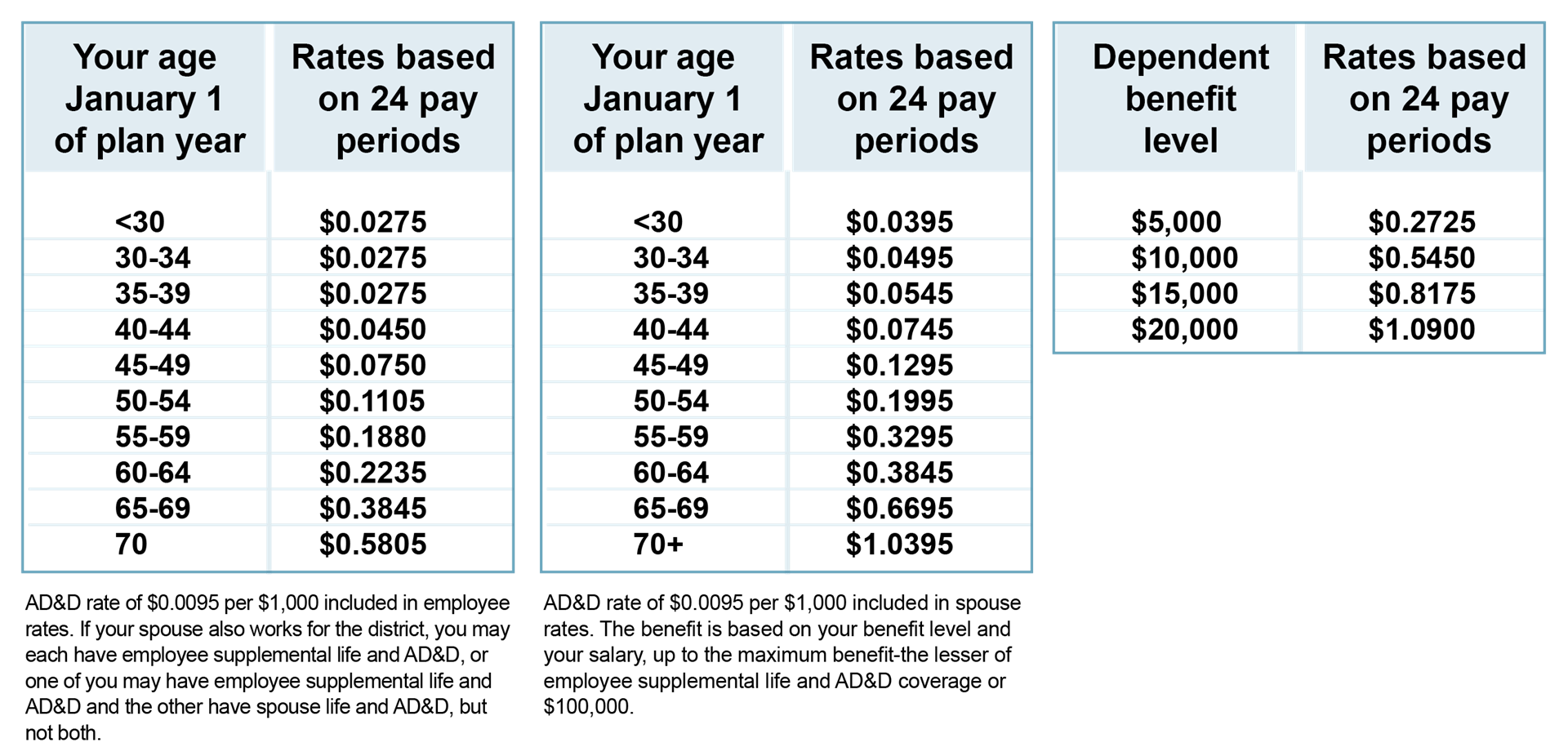

The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary. For those with medical issues it might be the best and most cost-effective means to obtain life insurance. In general ADD insurance premiums are tied to the amount of coverage you purchase.

Each age group is assigned a cost per amount of coverage. Accidental death policies are generally much much cheaper than life insurance because the overall number of. Say for example youre a 31-year-old man who qualifies for a rate of 100 per 1000 of coverage and this rate increases by 050 every five years.

Employee benefits especially insurance can be complicated. Voluntary term life insurance is a policy that offers protection for a limited period such as five 10 or 20 years. Voluntary life and ADD from work.

Basic AD D is employer-paid coverage which provides an accidental death benefit often equal to an employees basic term life insurance amount. For example monthly premiums might start at 450 for every 100000 in. Accidental death and dismemberment Insurance ADD is an insurance policy that offers coverage in case a person dies or becomes disabled.

Voluntary life insurance is a financial security and protection policy that at the time of the death of the insured policyholder pays a recipient or. What Is Voluntary Life and ADD Insurance. Lets say a person purchases an ADD policy worth.

Voluntary life insurance can be a valuable employee benefit. The ADD policy should be super cheap because they are close to worthless. Reviews Trusted by 45000000.

Accidental death dismemberment ADD insurance.

Voluntary Benefits Life And Ad D

Voluntary Life Insurance Quickquote

What Is Ad D Insurance Video Library

Accidental Death Dismemberment Ad D Insurance Bankrate

What Is Voluntary Life Insurance And How Does It Work

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance

Accidental Death And Dismemberment Insurance Policy Advice

What To Know About Ad D Insurance Forbes Advisor

How Does Voluntary Life And Ad D Insurance Work Cake Blog

What Is Voluntary Life Insurance How Does It Work In 2022

Ad D Vs Life Insurance Differences How To Pick

What Is Voluntary Life Insurance How It Works And Who Qualifies Prudential Financial

Life Insurance Vs Ad D Differences Explained The Motley Fool

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance